The currency pair went upwards last week due to the optimism on the trade conflict between the US and China. The US President has mentioned last week that the agreement between the two countries is waiting for his signature only.

ECB had held a meeting last week and made no changes to its monetary policy. They have left the monetary policy unchanged, However, economists expect the ECB to cut rates again in March 2020.

The Fed has also made no changes in its monetary policy. The interest rate remained unchanged. However, there are fears that the FOMC is going to ease its monetary policy in the future.

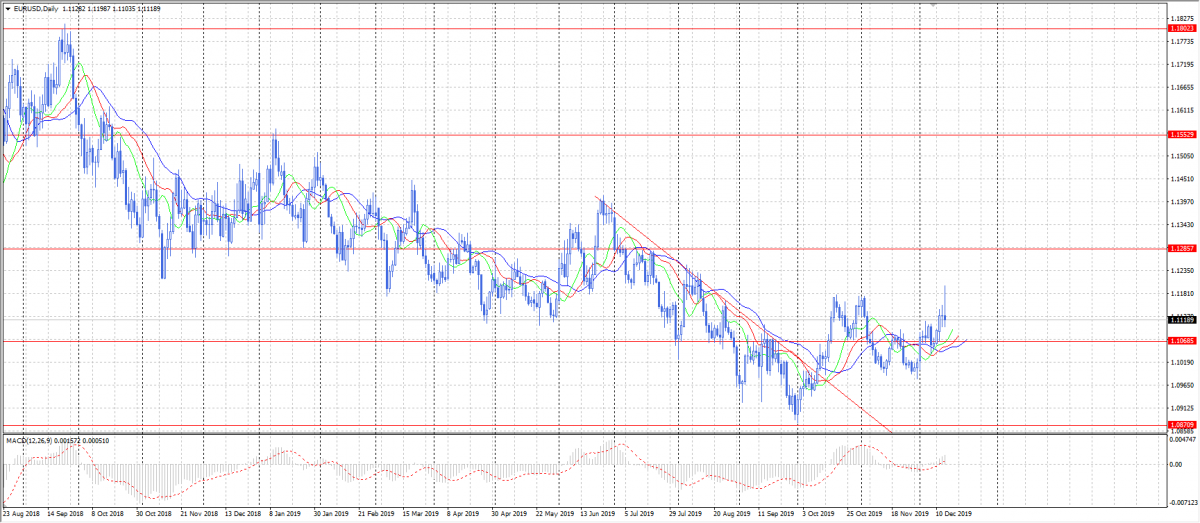

EUR/USD has some potential to grow fundamentally and technically. However, we can see a rather strange candlestick on Friday, which may be the first sign of a correction. Anyway, we expect the currency pair to develop its growth both directly or via a correction towards 1,1065.