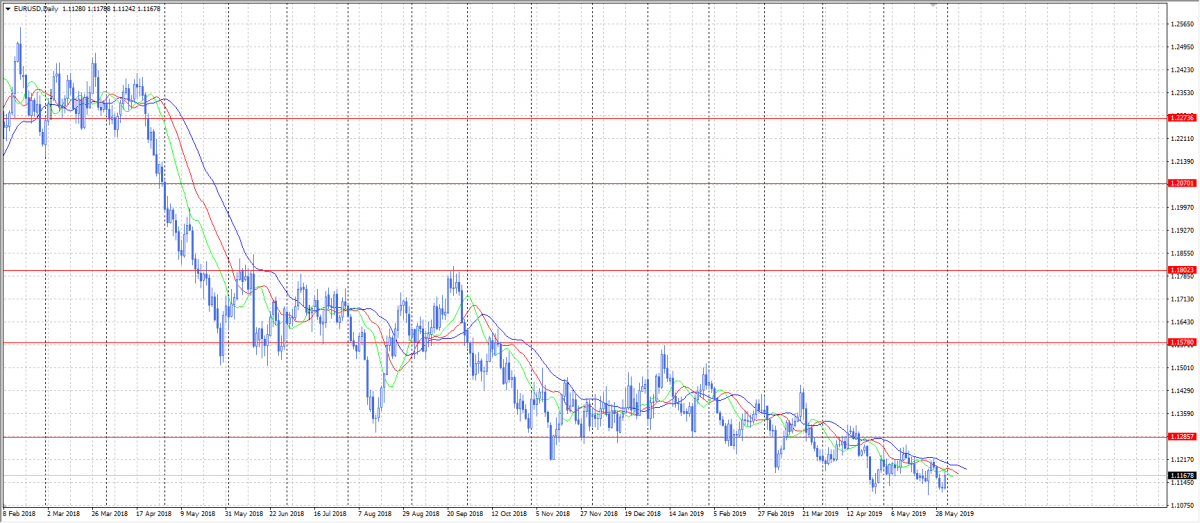

The currency pair failed to grow last week frustrating our growth expectations. EUR/USD declined towards local lows instead. However, the currency pair has found support close to the local lows and rebounded on Friday.

EURO is still under the pressure due to the situation within the Eurozone. German economic data is still mixed. Eurozone’s locomotive brakes affecting the whole train. Inflation data in Germany has shown growth, but it was slower than expected and far lower than previous reading.

Another reason for EURO to stay close to its local lows is Italy. The EU warns Italy about the consequences of breaking budget rules.

As for the US, there was no important data last week. However, we have paid attention to the FOMC members’ comments, hinting on the probability of monetary policy easing in case of economic decline. There is nothing strange in such steps, but why do they discuss monetary policy easing right now? Do they have some signals of economic growth’s slow down?

Finally, trade wars affect currencies as well. There are tensions between the US and China and US and EU. All this has negative impact on EURO.

The currency pair has almost reached local lows last week but rebounded. Our expectations are modest as the currency pair fluctuates in a tight range. We think that EUR/USD is likely to reach last week’s highs and there it may either break out or reverse again.