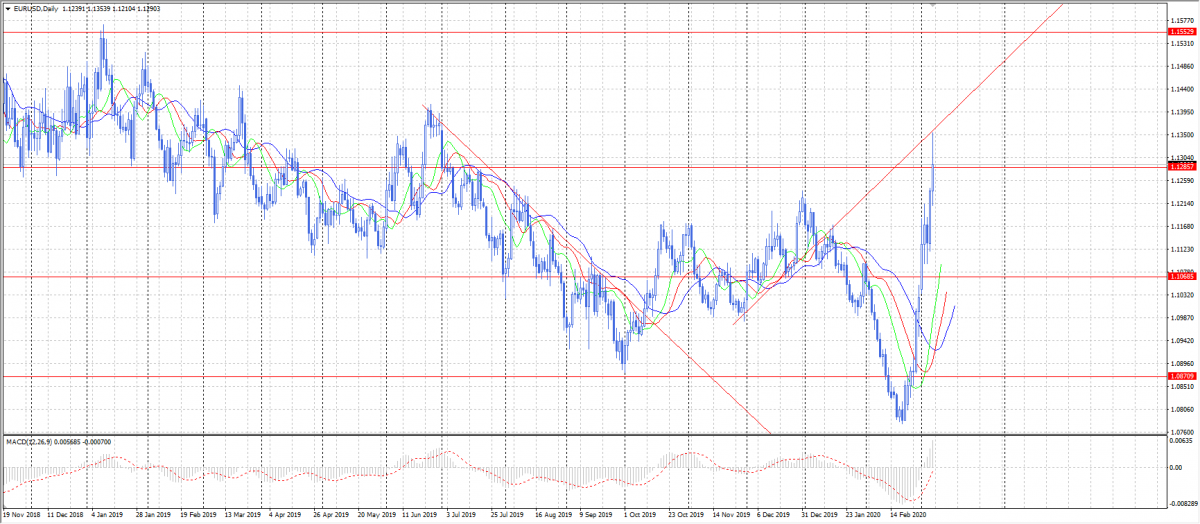

The currency pair went upwards sharply last week and tested the resistance at 1,1285. EUR/USD stays below this level at the moment of writing.

This growth’s driver was the emergency FOMC meeting and the decision of the Fed to cut rates. This decision was expected, as the US economy shows only no signs of growth. However, it is not clear why have they decided to do it in such an extraordinary way.

As for the US Labor market data, it was mostly positive. Unemployment rate declined to 3.5% while non-farm employment change data has shown 273 000 new payrolls.

The currency pair is able to develop its growth this week if it breaks out the resistance at 1,1285. Otherwise, EUR/USD will decline towards 1,1068.