The currency pair declined last week according to our expectations, but after the release of the ECB Meeting results, it went sharply upwards.

The logic here is in fact that the monetary policy easing was included in price already. The European Central Bank declined rates and launched new 20 billion euro QE.

As for the United States, Core CPI has shown 0,3% growth, which was equal to its previous growth. Economists expected 0,2% growth of inflation. Core Retail Sales had 0% growth as compared to its previous 1% growth. Economists expected Retail Sales to grow for 0,1%.

There is a bunch of PMIs data releases in Eurozone next week and we advise to pay attention to them.

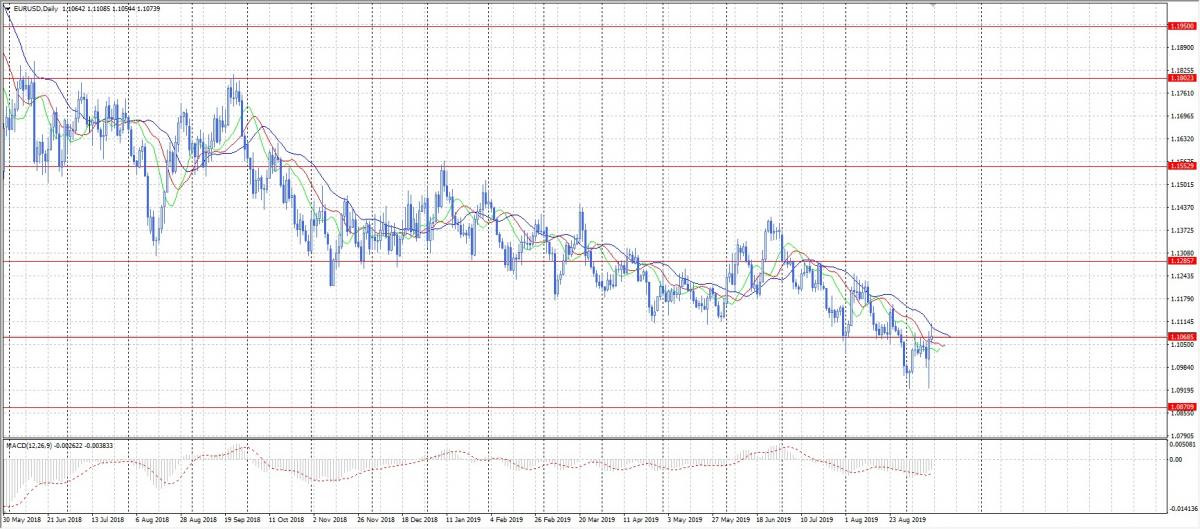

We can see a shooting star pattern on the chart, which means that EUR/USD is likely to decline towards 1,0870. However, if this signal is broken, the currency pair may move towards the next resistance at 1,1285.