The currency pair declined last week and reached the support at 1,1023. EUR/USD stays under the pressure as the Fed has declined the rates for 25 basis points only. The FOMC members has mentioned that this is not the beginning of the new low rates cycle, but the correction within the interest rates hike cycle.

However, USD failed to develop its success due to the weak US manufacturing data and mixed labor market data. The Unemployment rate remained at 3,7%. Economists expected the indicator to decline to 3,6%.

Average Hourly Earnings indicator has grown to 0,3%. Economists expected it to decline to 0,2%. As for the Eurozone, the main fears are connected to the probability of further easing as the inflation is far from target levels and the growth is also weak.

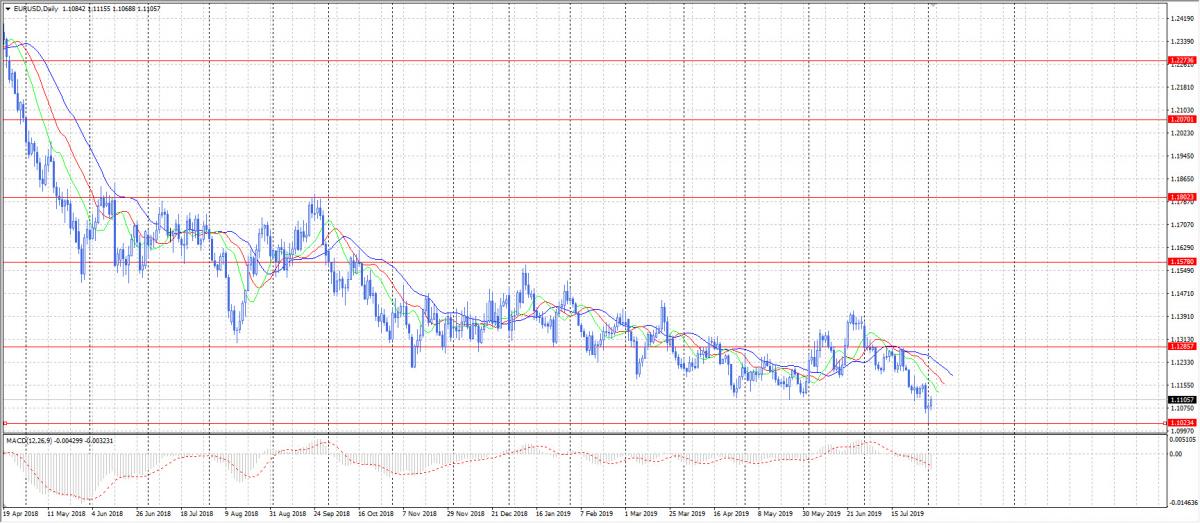

EUR/USD is under the pressure fundamentally, but we have a Hammer reversal pattern on the Daily chart meaning that the currency pair is able to reverse towards 1,1285.