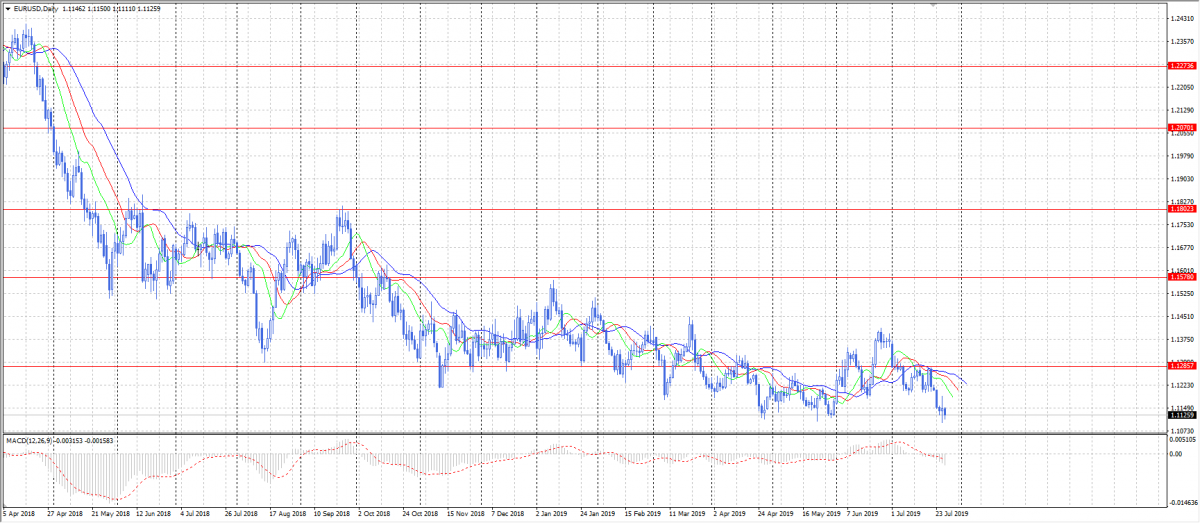

The currency pair declined last week and tested the lows of 2019 as the market participants expect the ECB to ease the monetary policy again.

The ECB’s meeting was the main event of the last week. The MPC has declared the possibility of the further monetary policy easing in case of necessity. European Central Bank has announced that they are going to hold the rates low until the mid-2020 at least.

Weak macroeconomic data pushes EUR/USD downwards as well. German and French PMIs were lower than expected. German Manufacturing PMI reached 43,1, which was weaker than forecasted and the previous reading.

French Manufacturing PMI was also weak. Services sector was below the forecasts and the previous reading.

As for the US, last week’s data was positive. Durable Goods Orders has grown to 1,2% and the quarterly GDP was above the expectations while being below the previous reading.

EUR/USD is likely to develop its decline fundamentally, but further downtrend is prevented by the 2019 lows. We have a uncertainty Doji model on the chart. If the price manages to break it out downwards, EUR/USD will develop its downtrend towards 1,0980.