The currency pair went upwards last week as first signs of risk appetite appeared. They are not based on fundamental drivers as the main market theme is Chinese coronavirus making the investors to buy shelter currencies like USD.

The currency pair went upwards last week as first signs of risk appetite appeared. They are not based on fundamental drivers as the main market theme is Chinese coronavirus making the investors to buy shelter currencies like USD.

FOMC members decided last week to hold the interest rates range unchanged. The Fed avoids to take any further steps currently as the have lack of data to make further conclusions.

Advanced GDP data had no changes as US economy has reached 2,1% growth, which is equal to the previous reading and economists’ forecasts.

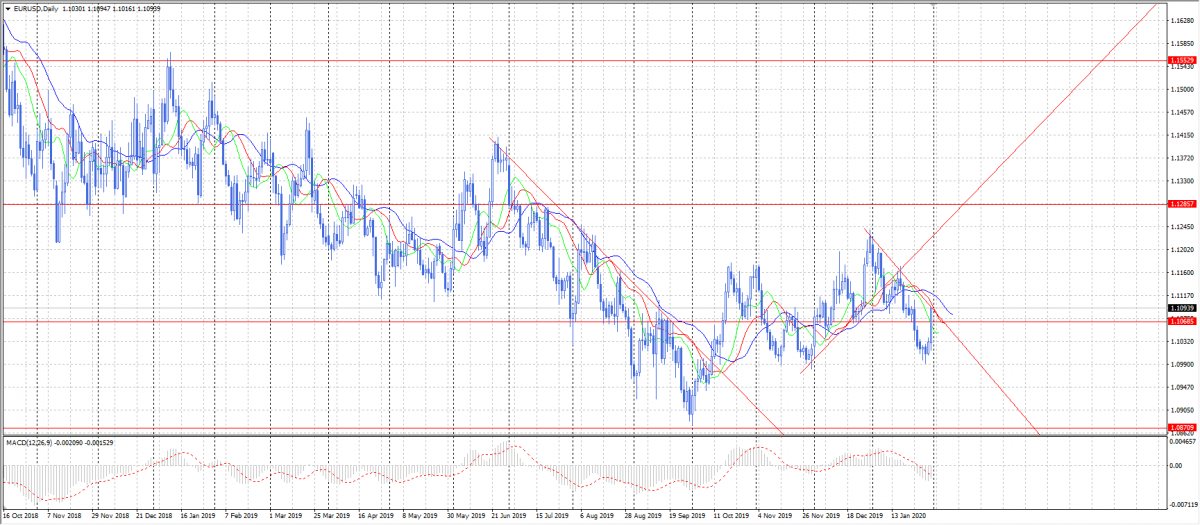

EUR/USD has broken out 1,1068 resistance areas, but it is not clear if it is going to develop this uptrend or move lower to retest 1,1068 again. In the first case, the currency pair is going to move towards 1,1285. In the second case the currency pair will retest the support at 1,1068 and move lower if successful.