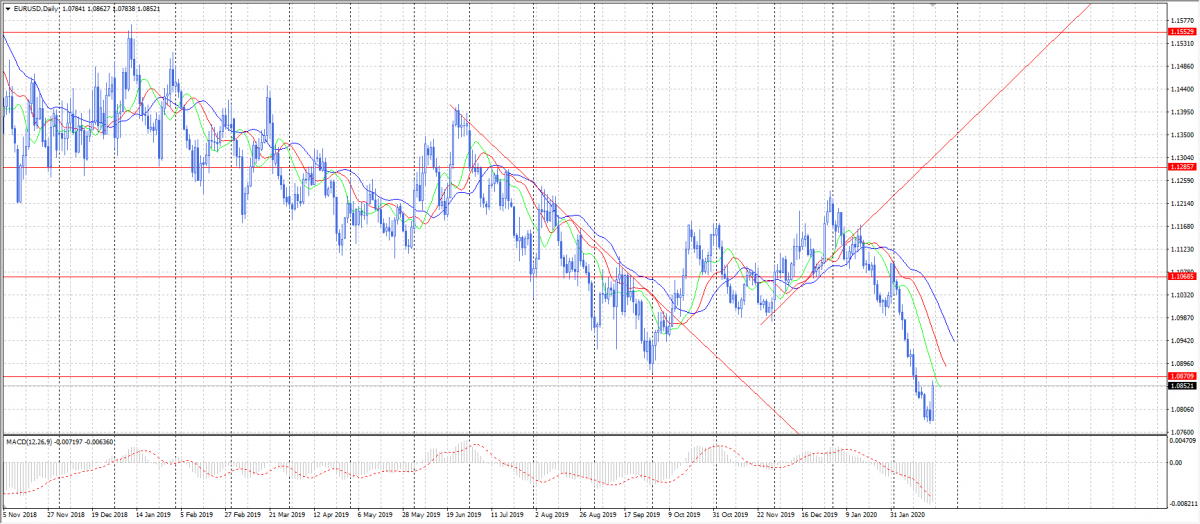

The currency pair declined last week according to our expectations, but had a correction on Friday and almost reached 1,0870 resistance level. The reason for this short correction were mixed Eurozone and negative US PMI data.

German Manufacturing PMI was better than expected and than previous reading, which looks optimistic regardless the fact that this indicator still stays below 50.

As for the US Manufacturing data, the indicator reached 50,8, which is below previous reading and expectations.

The currency pair is likely to test 1,0870 resistance level this week. If this level holds the price, EUR/USD is likely to fall again. Otherwise, we will see a new uptrend.