The example of a deal execution on the WebTrader platform

Our company offers traders the platform for binary digital contracts trading – WebTrafer. WebTrafer. Working on this platform our company’s clients not only have the possibility to buy digital contracts, but also monitor the current market situation and analyze already opened positions as well.

For traders’ convenience such modern technical analysis means as trend indicators and oscillators are available.

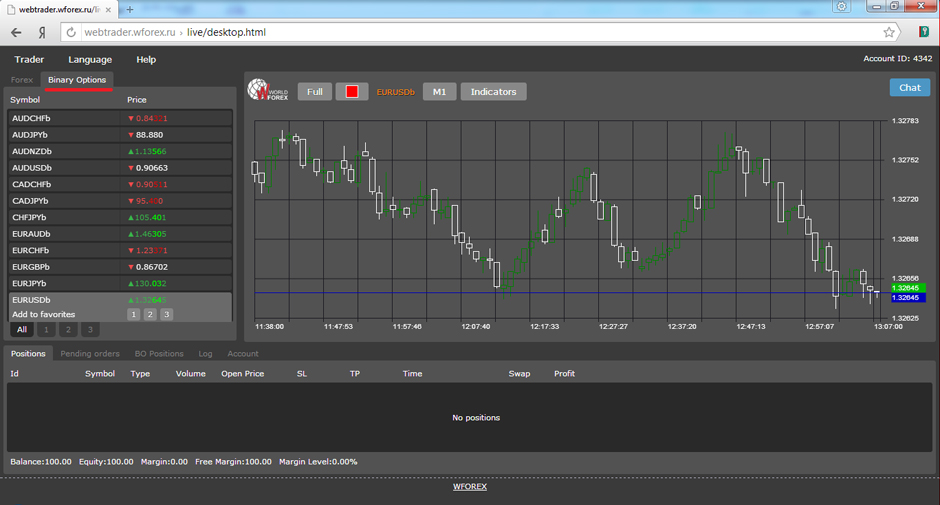

The use of”favorites” menu numbered 1,2 and 3 can be helpful. Here it is possible to add various assets in order to quickly navigate on them in the future following the specified tabs. The whole range of assets offered for trading can be seen by opening the “Digital contracts” tab (pic.1). All digital contracts assets include letter “b” at the end (EURUSDb, for example).

Pic. 1

Prior to commencing digital contracts trading, you should determine the asset base. For this purpose, while opening the Digital contracts tab select a required asset from the list by clicking a mouse on it. Upon that, a special “Quick buy” menu will appear where you can review the information about the asset base current price, the investment volume and the expiration period (in respect to the quick buy, the expiry time is always set on 60 seconds), the payout win ratio in case of a winning trade and the payout loss ratio in case of a losing trade. The “Quick buy” menu can be seen in picture 2.

Pic. 2

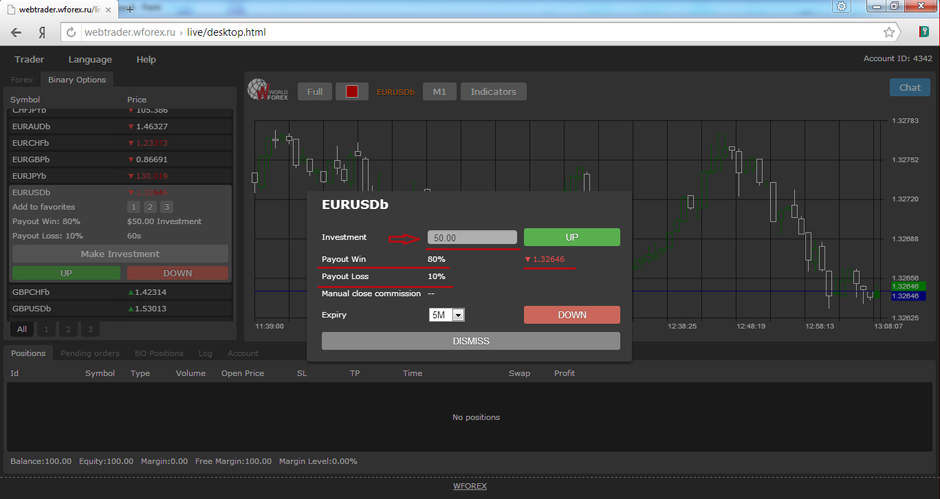

In order to get an access to the extended settings of a deal, “Make investment” parameter is to be selected. (shown in picture 3)

Pic. 3

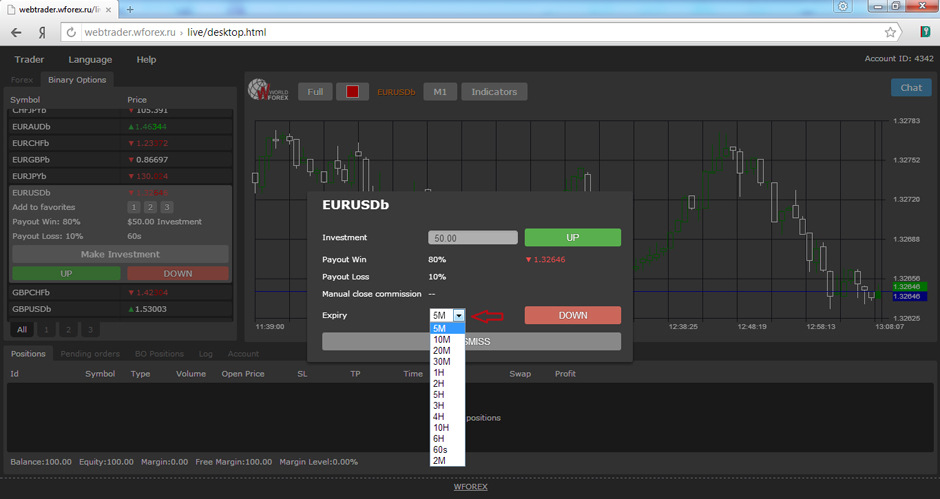

In this menu a trader can proceed to the extended deal parameters, where a volume of the investment to the digital contracts, for instance, can be specified. This can be done in the “Investment” window (pic.4). After a trader has determined the volume of the investment, an expiration period is to be chosen. This can be done in the bottom menu “Expiry”. The expiration time for which the forecast has been made and upon the expiry of which a deal will be successful needs to selected in the pulldown menu (pic.4). Upon selecting these parameters the system will automatically calculate the payout win in case of a successful deal and the payout loss if otherwise.

Pic. 4

Pic. 5

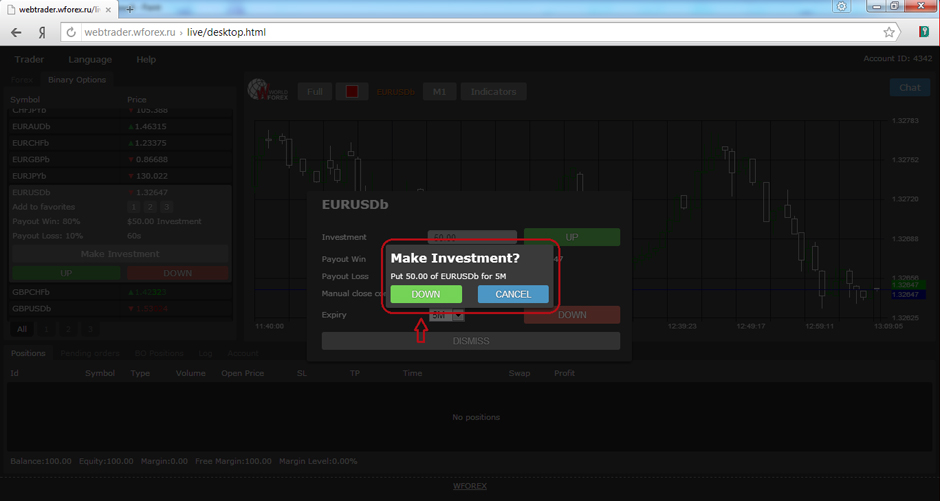

When the main deal parameters have been chosen, the direction of the price movement has to be determined. If it is expected that the asset base price will be above the current level, the digital contracts UP should be chosen. Alternatively, if you expect that the price will be below the current level, the digital contracts DOWN is be chosen. Picture 6 depicts the confirmation of buying the digital contracts in the chosen direction.

Pic. 6

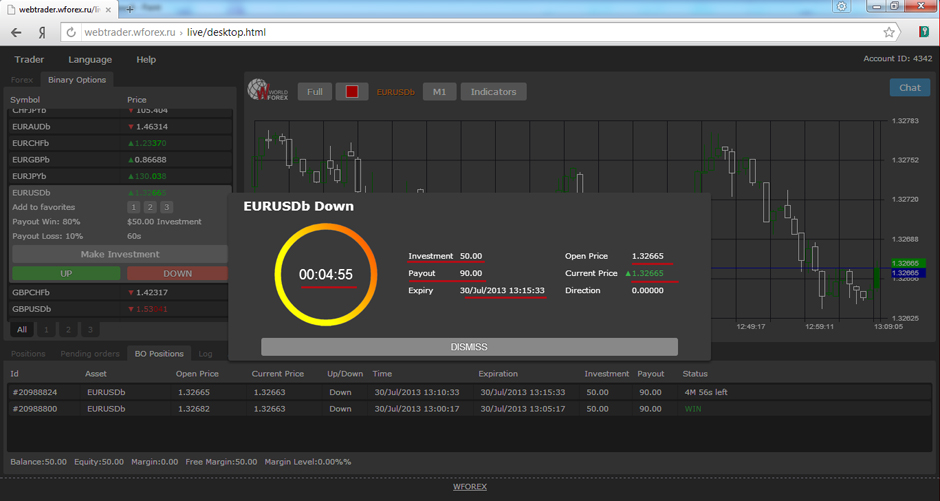

In the picture 7 a dialogue of the opened position with the set parameters can be seen. Here the time until the expiration, the expiration date and time, and also the volume of the investment, the current time, the open time, payout in case the client’s forecast turns to be true are displayed. The dialogue of the opened deal can be closed by clicking “DISMISS” and in the future called by double-click on the deal in the BO Position window.

Pic. 7

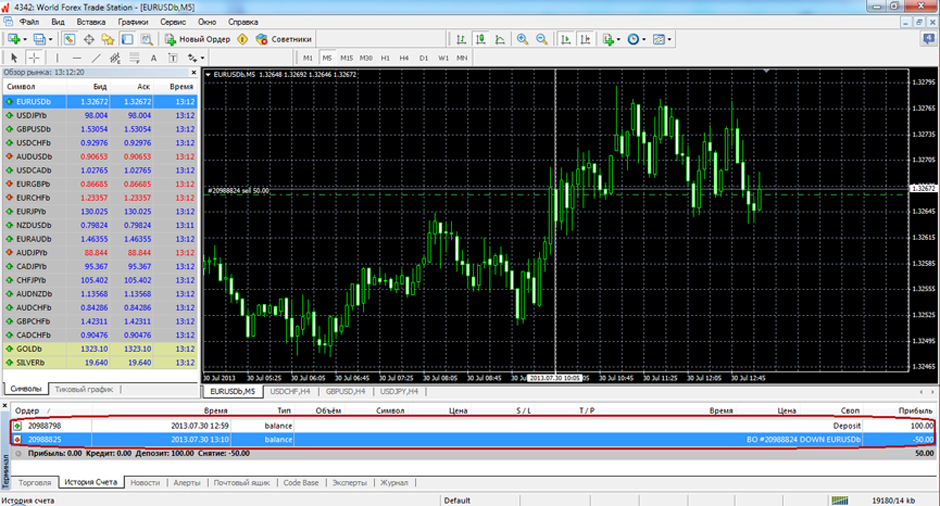

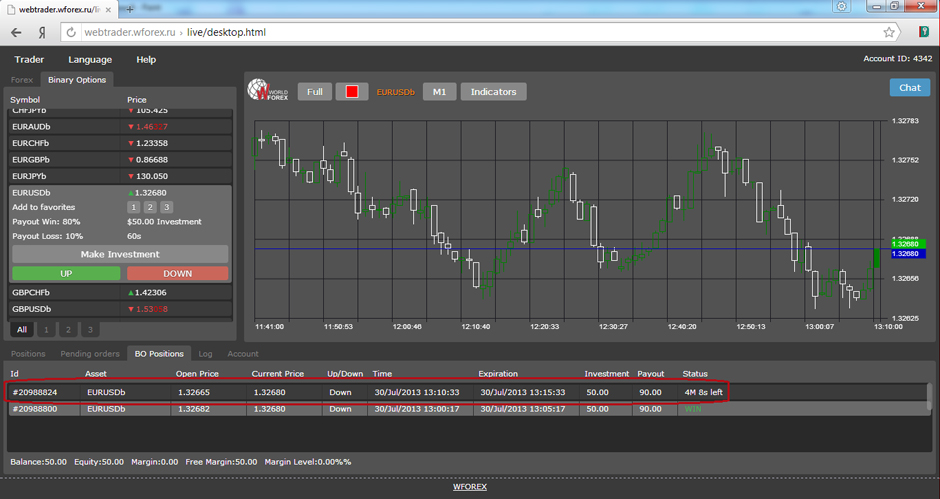

Metatrader 4 platform also allows reviewing the history and current state of the bought digital contracts in real time. Pictures 8, 9 depict the opened deal where the time of opening the deal, the contract type (SELL in this case means a lowering digital contracts DOWN), the volume of the deal means the amount invested in the digital contracts (50 in our case), asset base (EURUSDB), asset base price at the moment of buy.

Pic. 8

Pic. 9